The other day when I drove into town I felt a sneeze coming on, so I reached into my car’s pull-out coin drawer and grabbed a handkerchief. If I’d wanted a breath mint for my mouth or an eye drop for my contacts I’d reach into the same place. But I wouldn’t find quarters, dimes, nickels, or pennies anywhere in there. Come to think of it, someday soon I won’t find pennies anywhere at all.

You probably caught the headline in your news feed. The population growth of U.S. pennies is about to come to a grinding halt. Our country will no longer mint shiny new “Lincolns” for the first time since their debut in 1787. Two hundred years and change (ha) is a darned good run for a coin but the penny appears to have been done in by compelling arguments. One, the production cost is three times the face value. And two – and perhaps most humiliating – the penny’s face value has descended into, well, obsolescence.

You probably caught the headline in your news feed. The population growth of U.S. pennies is about to come to a grinding halt. Our country will no longer mint shiny new “Lincolns” for the first time since their debut in 1787. Two hundred years and change (ha) is a darned good run for a coin but the penny appears to have been done in by compelling arguments. One, the production cost is three times the face value. And two – and perhaps most humiliating – the penny’s face value has descended into, well, obsolescence.

There was a time not so long ago when I wouldn’t pass up a lost penny lying in the street. In addition to “free money” there was the old adage find a penny pick it up, and all day long you’ll have good luck. Today you’d better settle for just the luck because you can’t buy anything for pennies anymore. You’d be better off using them for more practical purposes like checking your tire tread depth or turning screws. My brother and his wife turned thousands of their pennies into a beautiful, copper-colored floor for their kitchen.

Speaking of copper (I’m easily distracted today) I had no idea pennies are no longer made of copper. They’re primarily zinc because of the rising cost of metals (yet they still cost three cents apiece?) You’d assume quarters, dimes, and nickels were made from an alloy of silver, lead, or aluminum, but – go figure – those coins are primarily copper.

Enough with the facts. I’m bummed to see the penny put out to pasture. Along with it goes a ton of childhood memories. You could roll pennies into coin wrappers and enjoy the thrill of exchanging the whole lot for paper bills at the bank. You could drop them into handheld banks for untold savings (and my banks were delightfully mechanical). Finally, you could walk into any 7-Eleven or drug store, hit the candy aisle, and find several “penny candy” choices. A chunk of Bazooka bubble gum, hard candies, or licorice whips could be purchased for just a few cents back then.

Enough with the facts. I’m bummed to see the penny put out to pasture. Along with it goes a ton of childhood memories. You could roll pennies into coin wrappers and enjoy the thrill of exchanging the whole lot for paper bills at the bank. You could drop them into handheld banks for untold savings (and my banks were delightfully mechanical). Finally, you could walk into any 7-Eleven or drug store, hit the candy aisle, and find several “penny candy” choices. A chunk of Bazooka bubble gum, hard candies, or licorice whips could be purchased for just a few cents back then.

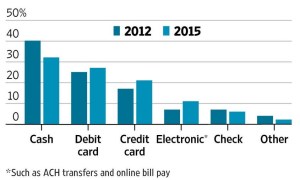

Practically speaking I’m on board with the penny’s retirement, because I can’t recall the last time I involved a cent in a financial transaction. If something costs $9.99, are you telling me you’d reach into your pocket and pay the $9.99 in cash and coin? Nope, you’d more likely hand over a ten-dollar bill and then what happens? You get a penny in return. What are you supposed to do with that?

Certain sayings will have to head out to pasture as well. An expensive item can no longer be described as “a pretty penny”. “A penny saved is a penny earned” literally has no value. A frugal person should now be described as a “quarter-pincher” (in case the nickel and dime are also on life support). And “pennies from heaven” certainly don’t describe good fortune anymore, even if the song of the same name will continue to be sung.

For my money, I hope car manufacturers continue to include coin drawers in their dashboards. I keep important things in there and I’d prefer not to change my ways. Then again maybe I should keep a few pennies in the drawer, if only for my childhood memories. Those will always have value.

LEGO Notre-Dame de Paris – Update #5

(Read about the start of this “church service” in Highest Chair)

I decided to have my lunch today while working through Bag 8… of 34 bags of pieces. That was a mistake. I reached for a LEGO piece, grabbed a little block of cheese instead, and Notre-Dame de Paris almost had cheddar in its walls. I immediately vowed food would go nowhere near the assembly ever again. It’s unnerving enough putting in the real pieces.

As I worked on the uppermost level you see here I used a little too much force, and a piece in the level below loosened and scampered down into the sanctuary. I shook, rattled, and rolled the entire cathedral trying to get it out but to now avail. Just before admitting defeat, the little devil finally emerged (he must’ve gone to confession). And here’s where I learned an unnerving truth: re-assembling pieces long after you’re supposed to can be near impossible. I had to tear down an entire wall to get the piece back in place. We’re working in close quarters here, people.

Today is also a good chapter to point out the tool to the right. It’s a “LEGO lever” (my words), designed to easily remove a piece from a place it wasn’t meant to go. I didn’t need my lever through the first seven bags, but today? Half a dozen times. My mind’s eye was off just a hair and I kept assembling pieces a quarter or half-inch off from where they were supposed to go. LEGO lever = life saver.

Bag 8 started slow and repetitious but finished grand and confident. In fact, I was so full of myself after the mere forty-five minutes of construction, I boldly plunged into Bag 9. Mistake. I mean, look at the pieces in this photo! Are these LEGOs or the little bits of pasta you find in your chicken soup? Seriously, we may be almost a quarter of the way through the bag count but the pieces are shrinking. Some Sunday soon the parishioners will look to the heavens and be burned by the giant magnifying glass above them.

Running build time: 4 hrs. 22 min.

Total leftover pieces: 17

Some content sourced from the CNN Business article, “Trump instructs Treasury to halt penny production”, and Wikipedia, “the free encyclopedia”.